It can be hard to keep up to date with changes in legislation and tax legislation in particular is hardly an exciting topic…

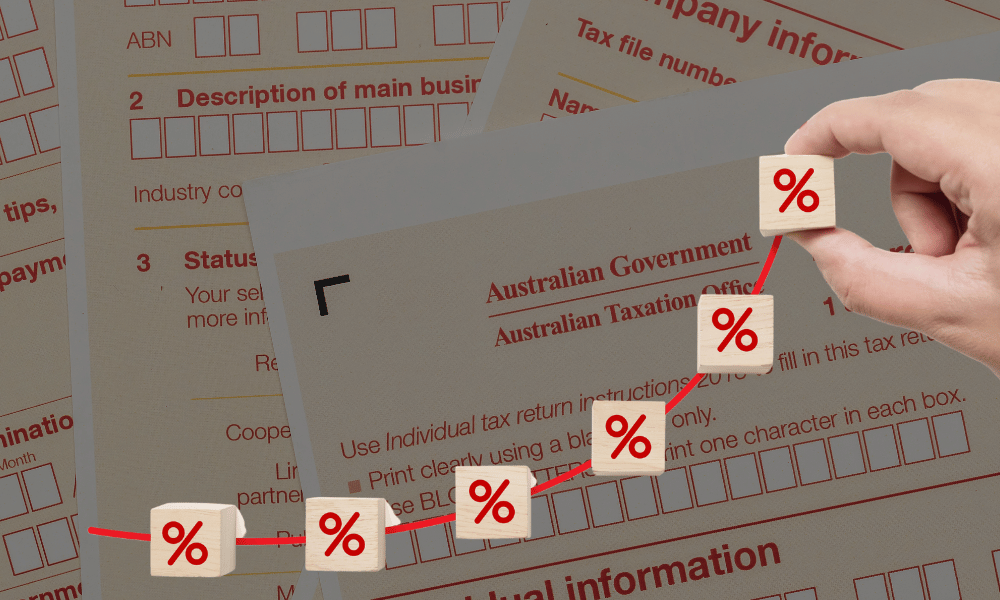

But, this time it’s different. If you owe the ATO money, even if you’re on a payment plan, interest paid to the ATO will no longer be tax-deductible.

What does this look like in practice? The ATO is currently charging interest at 11.17% compounding daily. If you had $50,000 in ATO debt that would mean you’re paying more than $5,500/yr in non-deductible interest. And you’re not chipping away at the principal. This works out to be about $15/day in interest payments. Essentially, you’re shouting the ATO lunch every day.

If you feel like you’re drowning in a sea of tax debt you might be comforted to know you’re not alone!

As you’re probably aware, in the wake of the Covid era, the ATO adopted a lenient stance toward small businesses GST, PAYG tax, and income tax obligations. However, the ABC recently reported that this period of leniency has come to a screaming halt and the ATO is now aggressively pursuing small businesses that owe tax debt, implementing stringent debt collection measures and shutting down businesses unable to comply.

The Current Situation

Rob Heferen, the commissioner of the ATO, recently highlighted the severity of the issue. According to ABC News, small businesses collectively owe the ATO about $24 billion relating to their business activity statements (BAS). Heferen expressed concern over the growing trend of businesses falling behind on these payments, noting, “We are seeing an increasing number of businesses fall behind on these types of payments, from which point it is very difficult for businesses to get back on top of their obligations and remain viable.”

The numbers are alarming. Small businesses account for 65% of all collectable debt owed to the ATO, which amounts to $34 billion. Over the past four years, the total collectible debt, from businesses and individuals, has surged from $26.5 billion in June 2019 to $54 billion in late 2024 — It has more than doubled! This sharp rise highlights the escalating pressures on small businesses across the country.

Aggressive Debt Collection

In response to the mounting debt, the ATO has intensified its debt collection efforts. Businesses with unpaid tax debts face the risk of being shut down if they fail to settle their obligations. The ATO’s hardline approach is a stark contrast to the leniency shown during the pandemic, and it serves as a brutal wake-up call for small business owners.

While the ATO is offering payment plans to help businesses manage their tax debts, these plans aren’t a get out of jail card and currently carry a general interest charge of 11.17%. Not only are you paying a high interest rate, these loans also have short repayment terms so your monthly payments can be astronomical. For many, meeting these repayment conditions may prove to be an insurmountable challenge, potentially crippling their operations.

As mentioned earlier, from July 1 2025, interest paid to the ATO will no longer be tax deductible. If there was ever a benefit to owing the ATO money, it’s now gone!

What Can Businesses Do?

We reached out to Antony Resnick, insolvency expert and partner at DVT Group to get his thoughts on what businesses can do if they are burdened by ATO debt. He cautioned not to drown in the sea of debt but to raise your hand and ask for help. Companies that lodge their BASs but do not have the money to pay their bill are far better off from a personal liability standpoint than those who don’t lodge and don’t pay.

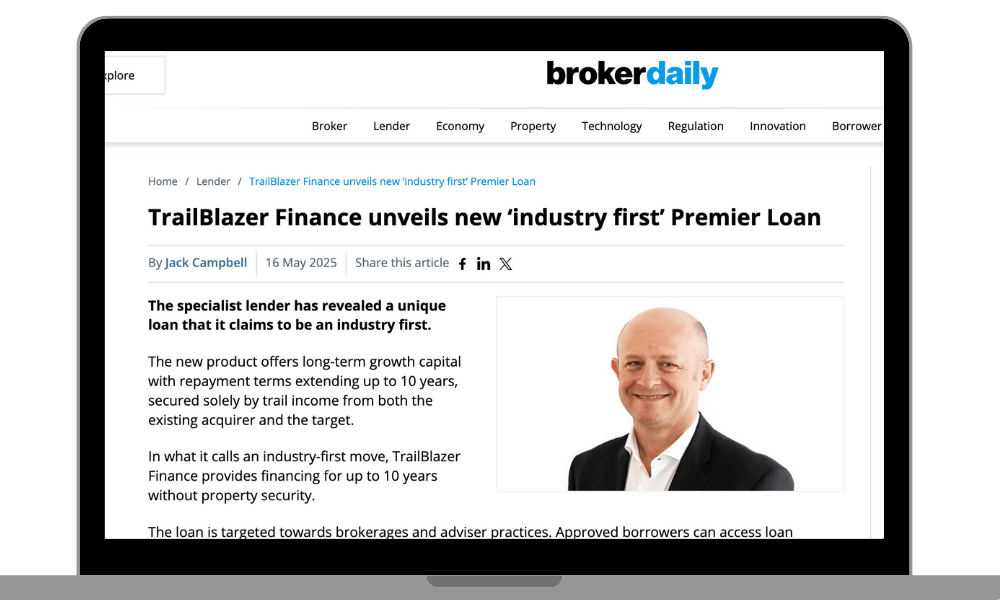

One option for businesses is to refinance the ATO debt through private lenders. TrailBlazer Finance is one of the few lenders willing and able to step up to the plate offering refinancing options that allow businesses to spread out repayments over five years, providing much-needed cash flow to continue operating and growing.

Take the First Step Toward Tax Debt Relief

If you’ve got ATO debt to pay don’t ignore it, raise your hand and ask for help. We understand the pressures small businesses face and are here to help you find a solution that fits your unique situation. We invite you to set up a complimentary call with our experienced team to discuss your specific circumstances and explore how our refinancing options can help you. Reach out to us today at 1300 139 003 or make an enquiry on our trailblazer website to clear the decks and get square with the ATO.

Simon Lewis, Sales & Growth Strategist at TrailBlazer Finance