How to protect your practice in a rising Interest Rates environment.

On the 3rd of May 2022 the RBA finally increased the cash rate by 25 basis points to 0.35%. Let’s get a little perspective here – Interest Rates in Australia averaged 3.89 percent from 1990 until 2022, reaching an all-time high of 17.50 percent in January of 1990 and a record low of 0.10 percent in November of 2020.

This was the first rate hike since November 2010. I am not a betting man, but an educated guess tells me this is just the beginning. We can expect many more interest rate increases over the next 12-24 months as the Government tries to get on top of inflation.

The official inflation rate is 5.1% but anyone who buys food, houses, cars or petrol (i.e. everyone) knows the real inflation rate is much higher.

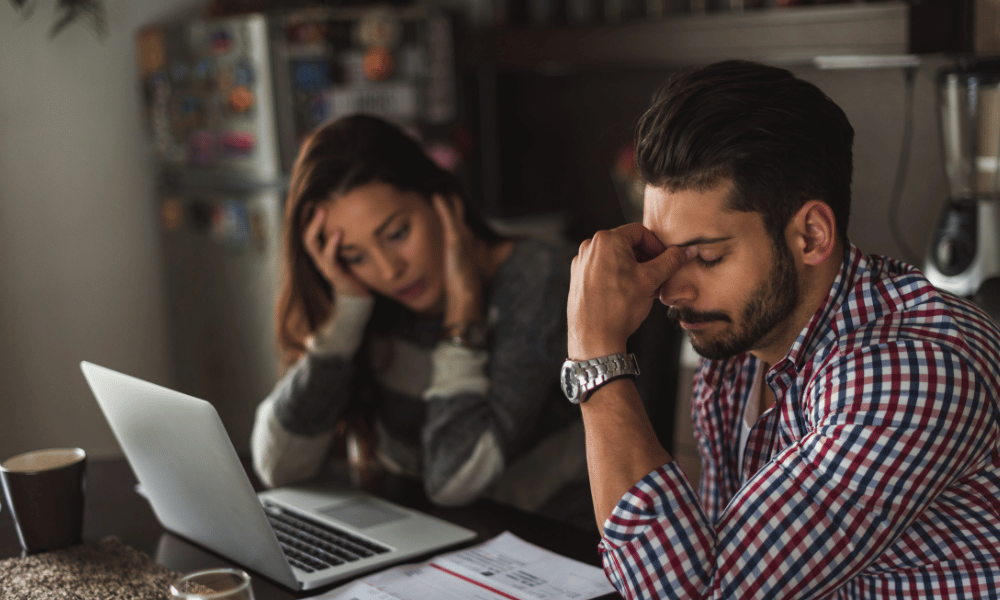

In an inflationary environment the cost of living rises way faster than wages meaning the money you have simply buys you less and sadly many people can’t afford the basics of life like food and shelter. Something must be done to slow down inflation. So, interest rates look set to rise.

What can you do in the face of rising interest rates to distinguish yourself?

Have an informed view – clients, particularly older clients, or investors relying on income, are going to be concerned. This is going to be a front-of-mind topic. Many will call you as their trusted advisor. After all, you deal with money don’t you? Therefore, they will look to you for insight and guidance (note, not that naughty word “advice”, but rather guidance and reassurance). Take time to read and gather some insights that resonated with you which you can share. Very few of my readers are economists – and even economists get it wrong more often than not! The important thing is to have a position and long after that is forgotten, you will be remembered for your considered approach and understanding manner.

Mortgages and loans are likely to get more expensive. – so, if you are a finance broker, refinancing existing loans to save customers an easy 1% will no longer be part of the playbook. But, locking a variable exposure to fixed at the right time may be a smart and very defensive play, or even a part into different duration fixed products can cushion the blow. Start to scour the market for lenders who offer fixed rate offerings that may not have moved. Our rates have not yet, but they probably will from July when the full impact of borrowing costs are passed on by the primary funders, so you may even be able to move quickly in some cases.

If you are a planner, or work with a planner or accountant, take stock of how much interest rate cover your client has. It may be that they are ahead on payments and have plenty of headroom, and simply quantifying this will give the priceless reassurance that is required that they can ride this through a series of increases.

What will it mean for your practice, brokerage or business? Deal flow will likely slow and you will need to accelerate new client prospecting because existing clients may be locked-in or only refinanced in the past couple of years. If property prices stagnate or possibly reduce, then the average size of loans may shrink and commensurately so will your commissions and fees if you have assets under management. So, time to start tightening the belt. The banquet table is not as plentiful, and the feeding frenzy is going to ease up.

But it’s not all doom and gloom.

As in all areas of life, the cream will rise to the top and the advisors and brokers who are smart and committed to adapting to rising interest rates will do well.

If you’re looking to profit from rising interest rates, here’s what you can do:

Early movers will get a jump on the rest and increase their volume over the next 6-12 months meaning they’ll make up for lower refinancing volume down the track. Plus, you’ll build loyalty with your clients meaning they’ll stick around for longer.

Acquire more new customers than ever before. Right now, interest rates are on everyone’s mind and clients are shopping around. This is the perfect time to increase your marketing. You don’t only need to grow “organically”. Some will see the change in monetary policy as the time to call it quits and having ridden the downward cycle, they will dismount from their ponies and sell. Here could be that golden opportunity to make sensible offers to acquire books and with them more new customers than ever before.

Invest in your own future now – you may be able to borrow money today while it’s still relatively cheap and particularly before the SME backed Government loans are set to expire on 30 June. The specialist fixed rate loans we offer are still available for brokers, advisors and planners looking to purchase trail books or hire more staff. An investment in your business now while money is cheap will stand you in good stead as interest rates rise and rise, because you can create a little war chest to go shopping.

Top Mortgage Brokers have systems in place to action the above with ease. For them it’s like switching sails on a sailing boat. The downwind sail is packed away and now it’s time to ‘tack’ their way through the headwind.

If any of the above feels like a challenge for you that’s ok, you can learn how to implement systems that make your business profitable in both declining and rising interest rates.

If you want to discuss how you can prepare for rising interest rates, reach out to our Head of Sales & Business Development Daniel Cordukes for a confidential discussion, you can reach him at danielc@trailblazerfinance.com.au.

Good luck,

Jeff

Jeff Zulman is the Founder and Managing Director of Trailblazer Finance, a specialist financial services lender offering business loans, valuations and M&A buy/sell advice, specifically tailored for Mortgage Brokers.