Industry consolidation is real — and it’s accelerating.

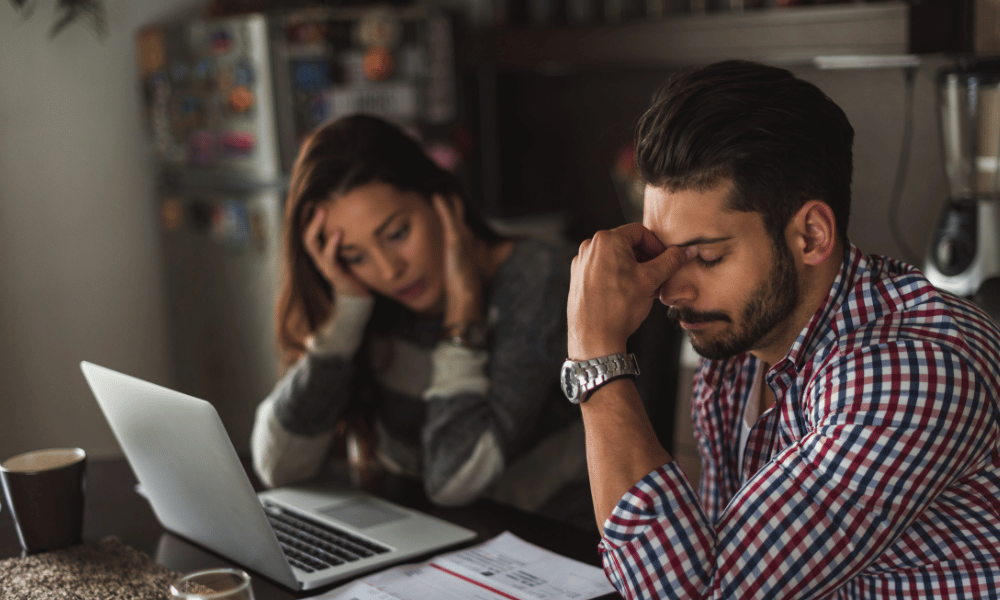

The big players are getting bigger by scaling and acquiring smaller participants. Meanwhile, many independent finance and advisory firms are finding it tougher to keep up, battling rising operational costs and tighter margins.

Is there still room for a successful start-up brokerage?

Absolutely. But today, the path to success requires a sharper strategy, greater resilience, and, crucially, access to growth capital.

At TrailBlazer Finance, we know that to not only survive but truly thrive, you must reach critical mass. You need a business model that generates consistent recurring revenue, covers fixed costs comfortably, and gives you the freedom to focus on strategic growth — not just daily operations.

But the road to critical mass isn’t always smooth.

The Growth Bottleneck: Cash Flow Constraints

If you’ve spotted the perfect acquisition opportunity — an under-serviced book that could double your business — but you can’t act fast enough because you lack access to funding, this is the solution for you.

Why Growth Capital Matters

The best brokers and advisers don’t just weather the tough periods — they accelerate through them.

They have the financial firepower to grow when the opportunities arise, not just when cash flow allows.

Once you hit critical mass:

- Your recurring income covers your fixed costs

- You have a capable team managing day-to-day operations

- Financial stress is reduced

- Every new dollar earned flows straight to your bottom line

It’s a game changer.

Mapping Your Growth Trajectory

Success starts with a clear growth plan:

- When will you make the acquisition?

- When should your marketing spend increase to support the acquisition?

- How do you scale your operations to the next level – staff, systems, offices?

The good news?

Financial services businesses tend to grow in predictable patterns.

With the right planning, you can map your growth trajectory years in advance.

Key indicators like the ratio of upfronts to trail income or your annual client acquisition rates can provide critical insights. They allow you to spot when your business is truly growing — and when it’s time to invest for the next leap forward.

But growth takes investment — in people, systems, marketing, infrastructure, and sometimes expert advice.

And that’s where TrailBlazer Finance comes in.

TrailBlazer Finance has been helping finance brokers and financial advisers grow for the last 14 years. We understand the growth hurdles you face and we’ve designed a new solution to help you overcome them.

Introducing the Premier Loan:

- Loan amounts from $250k to $2.5M

- Loan terms of up to 10 years

- No property security required (for loans under $1M — an industry first!)

The Premier Loan is tailored for established, well-run businesses with a clear plan for growth. It offers you the capital you need to scale confidently — without the pressure of short-term repayment schedules.

If you’re serious about reaching critical mass and building a highly profitable, resilient business, the Premier Loan could be the missing piece allowing you to grow through acquisitions.

As featured in Broker Daily:

Our new Premier Loan is making headlines as an industry-first solution tailored for brokers looking to fund acquisitions and scale with confidence. Read the full press release.

Ready to Power Through Your Growth Curve?

If you’d like a confidential discussion about your funding needs and to find out if you’re eligible for the Premier Loan, visit trailblazerfinance.com.au or call us on 1300 139 003.