Interest rates have been a hot topic in the news lately, with many people expressing concern about rising rates and their impact on the economy.

However, it’s important to remember that interest rates have varied significantly over time, and that the current rates we are seeing are just a small part of a much larger historical context. Let us look at the history of interest rates in Australia and how they compare to today’s rates, as well as what’s happening with interest rates in the United States and England.

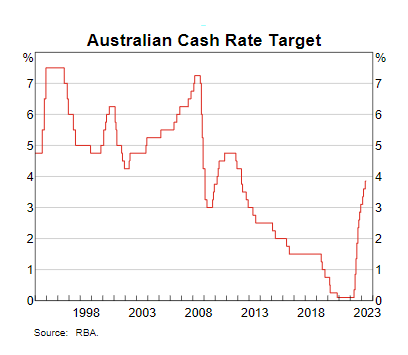

The official cash rate in Australia is 4.10% (I’m writing this in August 2023). This may seem like a high rate, but it’s actually relatively low compared to historical levels. During the pandemic, the cash rate reached a record low of 0.1%, but back in the 1980s and early 1990s, it was often in double digits, peaking at a whopping 17% in January 1990.

It’s a similar story in the United States, where the Federal Reserve sets the federal funds rate. Interest rates reached a low of 0% during the pandemic and are now sitting at between 5.25 and 5.50% which is closer to the historical norm.

In England, the Bank of England sets the bank rate, which is currently 5.25%. Again, we’ve seen a steep increase in the bank rate since the pandemic but, this is really a return to normal. A bank rate of 5.25% is in line with interest rates throughout the early 2000s. While interest rates in the 1980s and early 1990s were much higher, with the Bank of England’s rate peaking at 15% in 1989.

So, what causes interest rates to vary? Interest rates are influenced by a range of factors, including economic growth, global economic conditions and of course the word on the tip of everyone’s tongue right now – inflation. Central banks around the world use interest rates as a tool to help stabilise the economy and keep inflation under control.

Looking at the historical context of interest rates in Australia, the United States, and England can provide us with some important perspective on the current situation. While rising rates can be concerning, they are still relatively low compared to past levels. By keeping this in mind, we can make informed decisions that best serve us and our clients, rather than following market chatter or allowing fear to start to govern decisions.

Where will rates go from here? Well, I don’t have a crystal ball. But if they were to keep increasing it wouldn’t be out of the ordinary from an historical perspective. Remembering that Central banks don’t want to bring on a recession unnecessarily.

Jeff Zulman is the Founder and Managing Director of Trailblazer Finance, a specialist lender offering loans, valuations and business buy/sell advice to professionals including Mortgage Brokers, Financial Planners, Accountants and Real Estate Agents. If you’re ready to grow your business and want a confidential discussion with Jeff and his team, make an enquiry at https://trailblazerfinance.com.au/make-an-enquiry/.