Overview

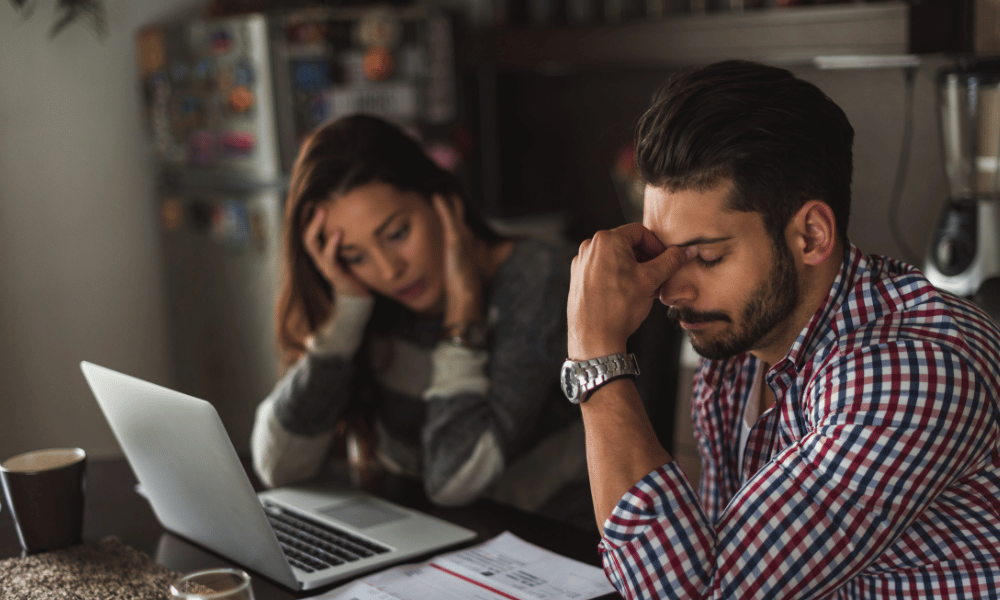

There was a time when finance brokers were united by a common goal: taking business from the banks. It felt like everyone was on the same team, carving out their share from a seemingly endless pie. But somewhere along the line, that dynamic shifted.

These days, it feels like brokers are taking business from each other instead of the banks. The pie hasn’t really grown, if anything, it’s starting to look a bit stale and now more and more people are elbowing their way in for a slice. It’s not exactly a feeding frenzy, but it’s getting crowded.

Throw in a higher cost of living, inflation, and an economic climate that’s tougher than most people care to admit, and it’s clear: it’s a hard time to be a broker.

When Growth Isn’t Real Growth

Now, let’s not ignore the elephant in the room… Yes, many brokers have been ‘growing’but in reality they’ve benefitted from growing property prices. Loan sizes went up, upfronts and trail followed suit, and on the surface it looked like strong growth. But let’s be honest: writing the same number of loans for larger sums is just a rising tide lifting the boat.

The problem? The tide’s turning. And the cost of staying afloat; staff, office rent, software, marketing, even your own mortgage, is rising. So that inflated growth? It’s being eaten up faster than you can say “inflation”.

Bigger Loans Won’t Save You

Sustainable growth, the kind that gives your business real value, comes from writing more loans, not just bigger ones. That means growing your client base, expanding your network, and building a pipeline that doesn’t rely on a booming property market.

But that kind of growth is hard work. And right now, it’s harder than ever.

So Why Are Brokers (and Trail Books) Worth So Much?

Here’s where it gets interesting. Despite the tough conditions, trail books and broking businesses are selling for higher multiples than ever before. Why? Because acquisition is the new growth strategy.

With organic growth slowing down, many brokers are buying their way to scale. And they’re not the only ones. Investors are also pouring money into trail books because they’re hunting for yield. Every other asset class; property, shares, gold, even Bitcoin, has gone up. So, trail books look like a smart bet with reliable cash flow.

Consolidation Is Coming

If you’re finding it hard to grow, you’re not alone. In fact, this environment is likely to lead to more consolidation in the industry. Bigger players, the ones with scale, systems, and staff are starting to acquire the smaller ones who are feeling the pinch. With scale they can absorb the rising costs and stay profitable.

The old rule of thumb was 1.3 brokers per firm on average. But we could be headed toward a future where that number is closer to 13. Not overnight of course, and I’m not pretending to be an oracle, but the writing’s on the wall.

In the end, the firms that survive this transition will be the ones that are well-positioned, well-funded, and built for scale. They’ll enjoy a bigger slice of the pie and that slice might end up being more valuable than ever.

How Do You Come Out On Top?

So how do you survive and thrive in this market? Get to critical mass before everyone else. And to win a race, you need fuel. Strategic funding can help you accelerate when conditions are right, and it can keep you going when they’re not.

The beauty of debt funding? It’s non-dilutive. That means when the dust settles, you still own your business and your slice of the pie.

At TrailBlazer Finance, we offer funding, advisory services, and valuations specifically for finance brokers. Whether you’re looking to grow through acquisition, solidify your base, or just get a handle on what your business is worth, we’re up for a confidential chat.

So if you’re growing tired of fighting your fellow brokers for a piece of the pie, and you want to build something that’ll reward you in 1, 5 or 10 years’ time, reach out. We’ll help you take a bigger slice.

👉 Make an enquiry

Try our free Trail Book Valuation Calculator to see what value your trail book has.