In the world of acquisitions, there are three fundamental questions every prospective buyer should ask themselves before engaging in any transaction. At TrailBlazer Finance, we specialise in guiding clients through the acquisition process, leveraging our vast experience to ensure optimal outcomes. Let’s delve into these crucial questions and how TrailBlazer Finance can assist you at each step of the journey:

Capacity Assessment:

Before diving into an acquisition, it’s essential to assess your capacity to manage and maximise the value of the acquired assets. Many trail book buyers, especially brokers and planners, overlook the importance of nurturing and transitioning acquired clients. At TrailBlazer Finance, we offer expert guidance to help you evaluate your capacity and develop strategies for effectively managing and growing your newly acquired assets.

Timing Evaluation:

Timing is everything in acquisitions. It’s crucial to assess whether you’re at a stage in your personal career and business development where you can capitalise on the acquisition. Our team at TrailBlazer Finance can help you evaluate the timing of your acquisition and determine whether it aligns with your goals and objectives. With our specialised knowledge and insights, we ensure that each acquisition translates into the greatest potential for client conversion, upselling, and the acquisition of recurring revenue.

Skill Suitability:

Acquiring a book requires more than just financial resources; it demands the right skills and expertise to effectively service acquired clients. Whether you’re dealing with sophisticated property investors or first-time homebuyers, having the appropriate experience is crucial. TrailBlazer Finance provides personalised support to help you assess your skill suitability and bridge any gaps in expertise. With our guidance, you can confidently navigate the complexities of the acquisition process and ensure a seamless transition for your clients.

By evaluating capacity, timing, and skill suitability, you can approach acquisitions with confidence and maximise opportunities while mitigating risks. At TrailBlazer Finance, we are committed to empowering our clients with the knowledge and resources they need to succeed in their acquisitions. Whether you’re exploring trail book acquisitions or opportunities in other domains, our team is here to support you every step of the way. For those interested in trail book acquisitions, try the FREE Trail Book Valuation Calculator to assess the potential value of your investment and make informed decisions.

From conducting due diligence to negotiating agreements and securing financing, TrailBlazer Finance offers comprehensive solutions tailored to your unique needs. With our expertise by your side, you can navigate the acquisition landscape with confidence and achieve your business goals.

So, if you’re a professional who’s looking for support from a funder that understands your business and is willing to back you while so many are turning their backs, then reach out to the team at TrailBlazer for a free confidential discussion about your circumstances. Click here to make an enquiry.

At a time where things feel uncertain, many lenders and businesses are choosing to play it safe, laying low in the face of rising costs of living, higher interest rates, and inflationary pressures. However, at TrailBlazer Finance we’re charting a different course—one of expansion, innovation, and total commitment to our clients.

Investing in Talent for Growth

Key to our expansion strategy is our investment in top-tier talent. We’re thrilled to announce the addition of several new team members to further support you. These include: Hayden Gomer – new Head of Operations, Pam Grevler – new Marketing Manager; and Kristy Coonan (who previously worked for TrailBlazer since its inception) is rejoining the team as a Lending and Special Projects Consultant. With their expertise and fresh perspectives, we’re taking our capability and efficiency to another level.

Empowering Borrowers with Lower Rates and Enhanced Products

Despite market conditions, we’ve taken the bold step of lowering our rates making our loans even more competitive in the market. And we’re excited to unveil a range of new products over the coming months, designed to empower you to qualify to borrow more for longer periods. Watch this space as they will roll out progressively.

Are You Acquisition Ready? Introducing Our Free eBook

Acquisitions are all the rage right now and for good reason. Successful acquisitions can fast-track business growth and improve efficiency overnight. At the same time, acquisitions can be fraught with danger. If you don’t know what you’re doing, or don’t take the necessary steps, you could be making a big mistake and jeopardising not only the business you acquire but also the business you already have and worked so hard to create. We’ve created an eBook called Acquisition Ready: The 10 Things Professionals Must Cover For A Successful Acquisition to help set you up for acquisition success. Click here for a complimentary copy.

Join Us on the Journey

Yes, the economic landscape is shifting (or has shifted), but we know now is a time when professionals and business owners need our help more than ever. We’re doubling down on our efforts to provide exceptional solutions to you. We’re committed to delivering the funding and support your business needs to thrive.

So, if you’re a professional who’s looking for support from a funder that understands your business and is willing to back you while so many are turning their backs, then reach out to the team at TrailBlazer for a free confidential discussion about your circumstances. Click here to make an enquiry.

The ATO’s $60B Debt Collection – The Times They Are A-Changin’

When the pandemic hit we saw a new lender enter the market. This lender was reasonably priced, had great terms and fast turnaround times.

Unfortunately, this lender is now starting to call in its debts.

The ATO’s $60B debt collection has begun and it’s time to get your ducks in a row so you’re not subject to the ATO’s “firmer action”.

During the pandemic the ATO placed a freeze on debt collection which gave relief to SMEs who were affected by the lockdowns, supply chain breakdowns, loss in consumer confidence and more. This approach was accommodative and necessary at the time but in the words of the immortal Bob Dylan, The Times They Are A-Changin’.

Of course, the ATO is not out to hurt anyone and they will help you if you put your hand up and don’t in their words, “stick your head in the sand”.

But, in the post-pandemic world (at least in theory…) it’s time for the ATO to start collecting their debts and get back to their core business of collecting taxes and not deferring payments.

If you have ATO debt, what’s the best approach for you and your business?

Do not ignore the problem.

CreditorWatch Chief Executive Patrick Coghlan has said “our data shows that court actions are back to pre-COVID levels and the ATO has also stated that it is ramping up legal action for outstanding debts.”

The July CreditorWatch Business Risk Index (BRI) shows that external administrations and court actions are up 50% since April and 46% year on year, while court actions are up 54% year on year.

Not all funders see ATO debt refinancing as a sign of weakness or distress. Mortgage brokers in particular are finance professionals who know a good opportunity when they see it. So, we understand that many availed themselves of the ATO’s accommodative stance – because they could. But now that game is over.

How to unwind your ATO debt in a structured way

Credit conditions still allow you to refinance and consolidate all your debts (including credit cards and other business related loans) into one loan so the principal and interest are paid down over a longer timeframe. This relies purely on your recurring trail, fee or commission income. This gives you the peace of mind that you won’t incur any additional charges or penalties, but in many cases, you may even qualify for a refund of interest.

At Trailblazer our turnaround times are fast, it takes only 3 weeks from enquiry to settlement. Loan amounts start at $30,000 and go up to as much as $1,300,000 for selected borrowers. Loan terms are flexible ranging from 2-5 years.

What you need is a clear plan to clear your ATO debt and unlock the working capital your business needs to grow and prosper. Set up your business for success this financial year and for years to come.

If you’d like a confidential discussion about clearing your ATO debt, you can reach out to Daniel Cordukes by calling him on 0416 062 572 or send him an email at:

danielc@trailblazerfinance.com.au.

Sincerely,

Jeff

Jeff Zulman is the Founder and Managing Director of Trailblazer Finance, a specialist financial services lender offering business loans, valuations and M&A buy/sell advice, specifically tailored for Mortgage Brokers.

How to protect your practice in a rising Interest Rates environment.

On the 3rd of May 2022 the RBA finally increased the cash rate by 25 basis points to 0.35%. Let’s get a little perspective here – Interest Rates in Australia averaged 3.89 percent from 1990 until 2022, reaching an all-time high of 17.50 percent in January of 1990 and a record low of 0.10 percent in November of 2020.

This was the first rate hike since November 2010. I am not a betting man, but an educated guess tells me this is just the beginning. We can expect many more interest rate increases over the next 12-24 months as the Government tries to get on top of inflation.

The official inflation rate is 5.1% but anyone who buys food, houses, cars or petrol (i.e. everyone) knows the real inflation rate is much higher.

In an inflationary environment the cost of living rises way faster than wages meaning the money you have simply buys you less and sadly many people can’t afford the basics of life like food and shelter. Something must be done to slow down inflation. So, interest rates look set to rise.

What can you do in the face of rising interest rates to distinguish yourself?

Have an informed view – clients, particularly older clients, or investors relying on income, are going to be concerned. This is going to be a front-of-mind topic. Many will call you as their trusted advisor. After all, you deal with money don’t you? Therefore, they will look to you for insight and guidance (note, not that naughty word “advice”, but rather guidance and reassurance). Take time to read and gather some insights that resonated with you which you can share. Very few of my readers are economists – and even economists get it wrong more often than not! The important thing is to have a position and long after that is forgotten, you will be remembered for your considered approach and understanding manner.

Mortgages and loans are likely to get more expensive. – so, if you are a finance broker, refinancing existing loans to save customers an easy 1% will no longer be part of the playbook. But, locking a variable exposure to fixed at the right time may be a smart and very defensive play, or even a part into different duration fixed products can cushion the blow. Start to scour the market for lenders who offer fixed rate offerings that may not have moved. Our rates have not yet, but they probably will from July when the full impact of borrowing costs are passed on by the primary funders, so you may even be able to move quickly in some cases.

If you are a planner, or work with a planner or accountant, take stock of how much interest rate cover your client has. It may be that they are ahead on payments and have plenty of headroom, and simply quantifying this will give the priceless reassurance that is required that they can ride this through a series of increases.

What will it mean for your practice, brokerage or business? Deal flow will likely slow and you will need to accelerate new client prospecting because existing clients may be locked-in or only refinanced in the past couple of years. If property prices stagnate or possibly reduce, then the average size of loans may shrink and commensurately so will your commissions and fees if you have assets under management. So, time to start tightening the belt. The banquet table is not as plentiful, and the feeding frenzy is going to ease up.

But it’s not all doom and gloom.

As in all areas of life, the cream will rise to the top and the advisors and brokers who are smart and committed to adapting to rising interest rates will do well.

If you’re looking to profit from rising interest rates, here’s what you can do:

Early movers will get a jump on the rest and increase their volume over the next 6-12 months meaning they’ll make up for lower refinancing volume down the track. Plus, you’ll build loyalty with your clients meaning they’ll stick around for longer.

Acquire more new customers than ever before. Right now, interest rates are on everyone’s mind and clients are shopping around. This is the perfect time to increase your marketing. You don’t only need to grow “organically”. Some will see the change in monetary policy as the time to call it quits and having ridden the downward cycle, they will dismount from their ponies and sell. Here could be that golden opportunity to make sensible offers to acquire books and with them more new customers than ever before.

Invest in your own future now – you may be able to borrow money today while it’s still relatively cheap and particularly before the SME backed Government loans are set to expire on 30 June. The specialist fixed rate loans we offer are still available for brokers, advisors and planners looking to purchase trail books or hire more staff. An investment in your business now while money is cheap will stand you in good stead as interest rates rise and rise, because you can create a little war chest to go shopping.

Top Mortgage Brokers have systems in place to action the above with ease. For them it’s like switching sails on a sailing boat. The downwind sail is packed away and now it’s time to ‘tack’ their way through the headwind.

If any of the above feels like a challenge for you that’s ok, you can learn how to implement systems that make your business profitable in both declining and rising interest rates.

If you want to discuss how you can prepare for rising interest rates, reach out to our Head of Sales & Business Development Daniel Cordukes for a confidential discussion, you can reach him at danielc@trailblazerfinance.com.au.

Good luck,

Jeff

Jeff Zulman is the Founder and Managing Director of Trailblazer Finance, a specialist financial services lender offering business loans, valuations and M&A buy/sell advice, specifically tailored for Mortgage Brokers.

Connective Asset Finance has announced the appointment of specialist lender, TrailBlazer Finance, to its panel.

The addition of TrailBlazer Finance introduces a funder whose sole focus is unlocking the value of intangibles to which lenders ordinarily give little or no value. This specifically benefits financial planning, property management, accounting and insurance brokerage clients who are typically hard asset-light but have built great recurring revenue streams. This allows them to monetise their recurring revenue without needing property to secure their loan facilities.

Read More

We recently launched a new low repayment loan for mortgage brokers and financial planners. Designed to boost cashflow, the Balloon Booster is structured like a balloon loan and features lower monthly repayments and flexible end-of-term refinancing options, allowing the balloon to be paid out or refinanced into a two-year loan.

Importantly, the loan product allows brokers and planners to better manage cashflow and maximise working capital at a time when many small businesses are struggling with their short-term cashflow needs.

Jeff Zulman, Managing Director of TrailBlazer Finance commented, “We know from talking to our clients that right now many brokers and planners need a short-term cash boost to free up working capital as they navigate the evolving post-COVID-19 market.

The Balloon Booster is designed specifically for this purpose. It is a low repayment product, with repayments 50 per cent or lower than those of our standard loan product. This helps our SME clients manage cashflow when they need it most.”

The new loan product further strengthens the specialist lender’s offering to its broker and planning clients, with Mr Zulman adding, “TrailBlazer Finance is committed to delivering the best possible solutions for these white-collar professionals. We are proud to be able to provide a product which is tailored to the needs of our clients, and the industry more broadly at a time when others are tightening their credit criteria and raising rates.”

In an excerpt from his recent interview with Stuart Donaldson at the Mortgage Business Commercial Masterclass, M&A specialist and TrailBlazer Finance Managing Director, Jeff Zulman, explains why brokers who can hold on through the current cycle will emerge stronger.

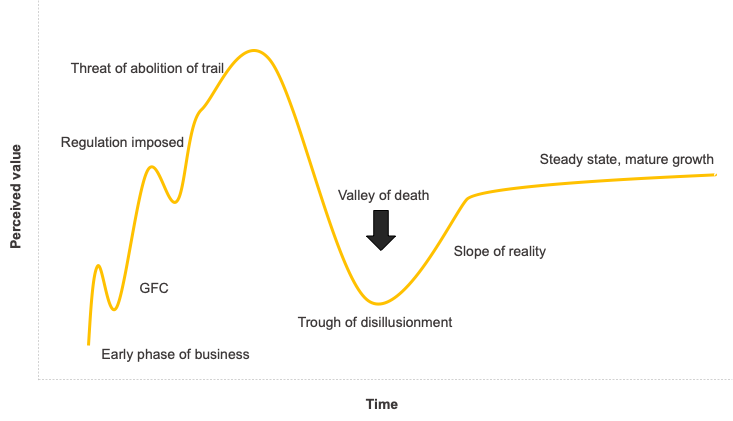

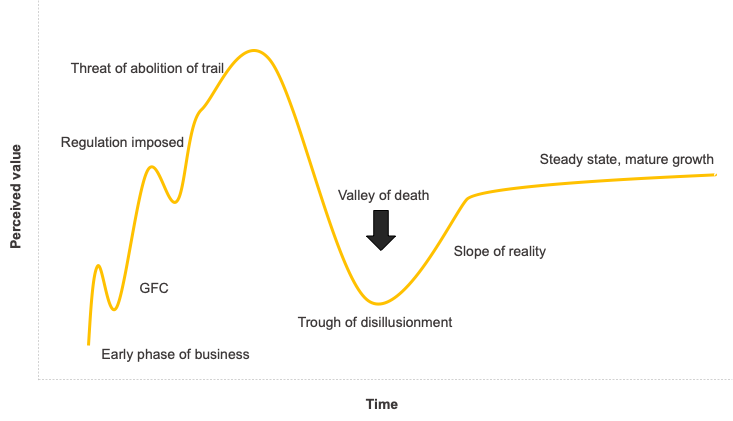

Adapting Geoffrey’s Moore’s Crossing the Chasm, which taught the start-up community how to leap the chasm between early adopters and the early majority, Jeff applies this model to the mortgage broking industry in a COVID-19 landscape.

He surmises that the Australian mortgage broking industry has experienced its halcyon stage, growing its market share from 18% in 2002 to a high of 60% in 2019 to hover around 55% in 2020 (Source: MFAA). Along the way it has suffered a litany of setbacks – the GFC, increased regulation and then the threat of abolition of trail – and finally finds itself in the COVID-19 chasm, the “valley of death”.

For those brokerages with the strength and resilience to survive this current phase – those that can demonstrate their ability to transcend cycles, build value and sustainability and come out the other side – steady, mature growth awaits, and, with it, tremendous opportunities from an M&A perspective.

Watch the short interview: M&A expert Jeff Zulman tells mortgage brokers to hold on

Crossing the COVID-19 chasm

If you are looking for advice around acquiring or selling trail books or need a cash flow boost, contact us today for a confidential conversation.

It goes without saying that large and small businesses alike are facing unprecedented challenges in the current environment. Brokers are certainly well-versed in how to hand tough times. What we know from those times is that where there are challenges there are invariably opportunities. Sometimes it’s simply a question of finding a partner to help you realise those opportunities when they present themselves.

In 2014, Chris Booth caught wind of an unmissable opportunity. At the time, he and his other business partners were running a successful full-service financial advisory business, Announcer Mortgages (now Infocus).

When they were offered the chance to buy an undervalued client book, an acquisition that would allow them to increase their footprint and further diversify their business, they decided to try to pull together the funds to make it happen. Knowing the book would eventually appreciate, they hoped to engage, convert and grow as many clients as possible before selling the book at a higher multiple.

Chris Booth, Head of Lending, Infocus

Finding funding

Having pooled their income streams, Chris and his partners shopped around for lenders to fund the purchase. Unhappy with the options available to them, Chris spoke to the Executive Director at his aggregator who facilitated an introduction to TrailBlazer Finance’s Managing Director, Jeff Zulman. Using a specialist trail book loan from TrailBlazer, Chris and his partners were able to borrow against Announcer’s mortgage trail book, rather than risk personal assets, in order to free up the capital to buy the book.

“In the end, we proceeded with the loan purely because of Jeff and the team. They made themselves physically available to us throughout the process and it gave us great confidence, both personally and professionally, that we were making the right decision with the right lender.”

Making growth happen

At the time of purchase, Chris was working with another part-time broker. While the business didn’t convert quite as many clients as they’d bullishly projected, they did manage to sign on around 500 fee-paying full-service clients from that book alone. By the time he and his partners decided to sell the business three years later, Announcer had increased in size to three full-time brokers, their client roster had more than doubled and the business had grown by almost 130 per cent in terms of the underlying trail. They subsequently sold the business to Infocus in 2017, repaying any remaining debt and banking a tidy sum.

Words of advice for brokers looking to grow

While Chris is the first to admit the industry is in a very different place in 2020, post-Royal Commission and mid-COVID pandemic, he would do it all over again. As a small business success story, does he have any advice for other brokers seeking to grow their business through acquisition?

“Using borrowed money is a good way to acquire clients and build your business quite quickly. You have a warm opportunity to call which makes it so much easier than building a book from scratch. Would I buy a mortgage book right now? Absolutely yes, the multiples are good, even though the market has some unknowns after the Royal Commission.

Acquisitions done properly absolutely work. However, be ready for it to take far longer than you’d expect to work a client book effectively. Ultimately, you still have to win the hearts and minds of the clients. One of the biggest learnings from the financial planning industry is that they didn’t try to win the clients. You have to call and build relationships, be proactive and be positive. Building those relationships is everything.”

Let us help

If you would like to find out about how we can help your business grow with our unique loan products for brokers and other white-collar professionals, please contact us on 1300 139 003 or at info@trailblazerfinance.com.au