We’re aware that as an insurance broker, you operate in an ever-changing and dynamic industry. While you’re staying on top of industry trends and changes, you’re also meeting your clients’ demands and managing the day-to-day activities of your business. With a rich understanding of the industry, we have tailored a loan product just for insurance brokers. Our product is affordable, customisable, low hassle, and utilises the value built up in your recurring revenue rather than risking property or other tangible assets.

$50,000 up

to $1,600,000

2-5 years

Up to 65%

Monthly

(in arrears)

Business and recurring revenue information on hand

on hand.

Fast indicative loan approval and access to funds.

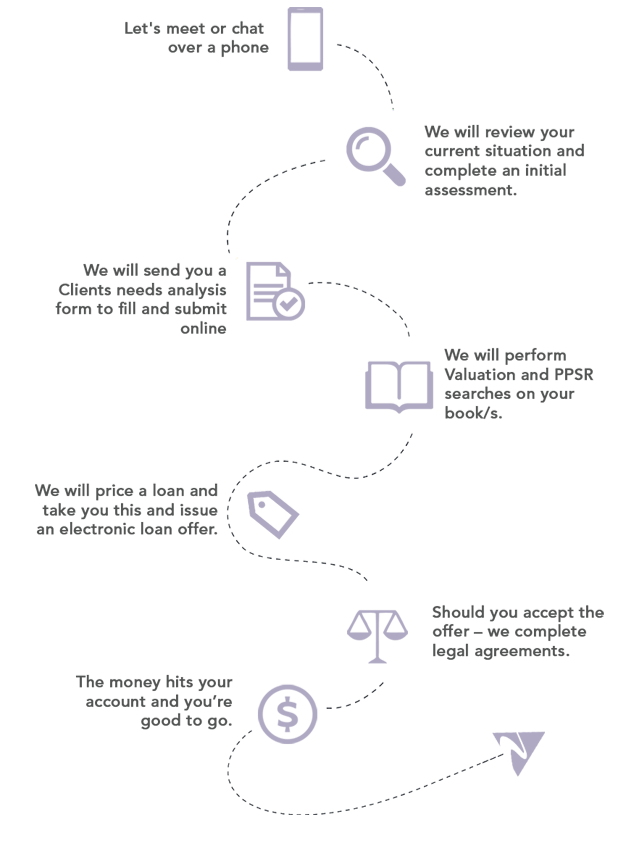

When you’re trailblazing, it helps to have someone with you who has blazed the trail before. That’s why we’re the perfect choice to guide you step-by-step through the process, minimising hassle to you. We can even work directly with your aggregator if that makes it easier.

We realise that your business is unique and complex. That’s why we never assess your situation with a ‘cookie cutter’ approach. First, we listen. Then we undertake a comprehensive valuation of your trail book which allows us to customise a loan, specifically tailored for your situation. It’s a new way to inject cash into your business, with terms that will help your business prosper.

You deal with the decision-maker. Even if traditional lenders have turned you down, we might still be able to help because we’re independently funded specialist lender and can assess your loan on its own merits. We pride ourselves on our transparency and we will personally notify you of our lending decision as soon as we have made it.

The banks don’t understand trail books. But we do. That’s why we developed our proprietary trail book appraisal model using proven algorithms to determine the current value of your business’s future cash flow. We’re so confident in our valuation that we lend against it – or are willing to buy your trail book for that price.

Because we’re invested in your continued success, we’re happy to offer guidance and expertise to help you achieve your vision and bring your ideas to market. If you choose to work with us, we’ll support you with tools and advice to help you grow, because your success is our success.

We offer a variety of loan products for you to choose from. These include facilities that let you draw down money as you need it, so you have the security of having your own facility locked in, but pay no interest to pay until you actually draw funds. Then you only pay interest on the funds you use. This gives you a flexible and convenient source of funds when you need it most – as well as peace of mind.