AFG has announced a new outsourced trail book marketplace for brokers through an arrangement with specialist cashflow lender and Mergers & Acquisitions advisory firm, TrailBlazer Finance.

Read More

The aggregation group has appointed a specialist lender, TrailBlazer Finance, to its asset finance panel, making more products available to its broker members.

Australian Finance Group (AFG) has welcomed trail book lender TrailBlazer Finance to its asset finance lender panel.

The addition will provide AFG brokers and their white-collar clients with access to the lender’s funding products and advice, which is specifically created for those with recurring revenue streams, such as brokers, financial planners, accountants, real estate managers and other cash flow businesses.

Read More

We recently launched a new low repayment loan for mortgage brokers and financial planners. Designed to boost cashflow, the Balloon Booster is structured like a balloon loan and features lower monthly repayments and flexible end-of-term refinancing options, allowing the balloon to be paid out or refinanced into a two-year loan.

Importantly, the loan product allows brokers and planners to better manage cashflow and maximise working capital at a time when many small businesses are struggling with their short-term cashflow needs.

Jeff Zulman, Managing Director of TrailBlazer Finance commented, “We know from talking to our clients that right now many brokers and planners need a short-term cash boost to free up working capital as they navigate the evolving post-COVID-19 market.

The Balloon Booster is designed specifically for this purpose. It is a low repayment product, with repayments 50 per cent or lower than those of our standard loan product. This helps our SME clients manage cashflow when they need it most.”

The new loan product further strengthens the specialist lender’s offering to its broker and planning clients, with Mr Zulman adding, “TrailBlazer Finance is committed to delivering the best possible solutions for these white-collar professionals. We are proud to be able to provide a product which is tailored to the needs of our clients, and the industry more broadly at a time when others are tightening their credit criteria and raising rates.”

In an excerpt from his recent interview with Stuart Donaldson at the Mortgage Business Commercial Masterclass, M&A specialist and TrailBlazer Finance Managing Director, Jeff Zulman, explains why brokers who can hold on through the current cycle will emerge stronger.

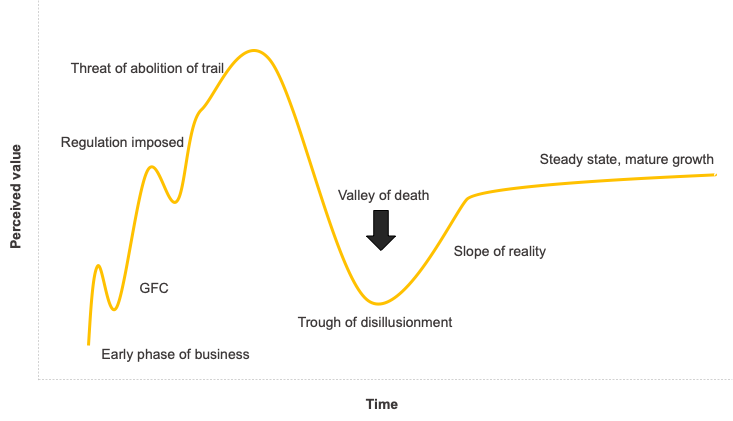

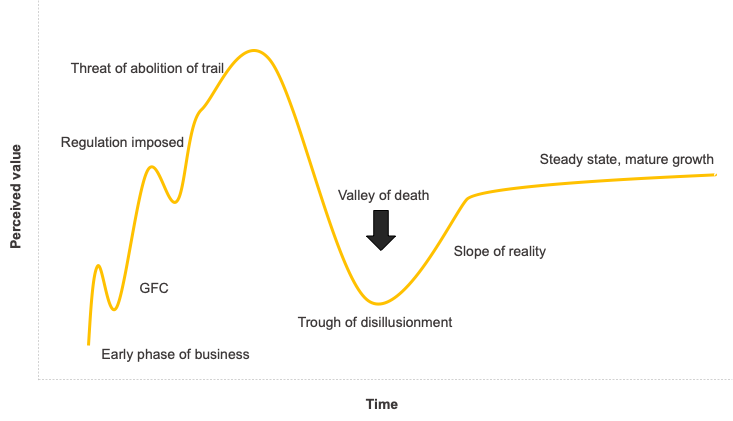

Adapting Geoffrey’s Moore’s Crossing the Chasm, which taught the start-up community how to leap the chasm between early adopters and the early majority, Jeff applies this model to the mortgage broking industry in a COVID-19 landscape.

He surmises that the Australian mortgage broking industry has experienced its halcyon stage, growing its market share from 18% in 2002 to a high of 60% in 2019 to hover around 55% in 2020 (Source: MFAA). Along the way it has suffered a litany of setbacks – the GFC, increased regulation and then the threat of abolition of trail – and finally finds itself in the COVID-19 chasm, the “valley of death”.

For those brokerages with the strength and resilience to survive this current phase – those that can demonstrate their ability to transcend cycles, build value and sustainability and come out the other side – steady, mature growth awaits, and, with it, tremendous opportunities from an M&A perspective.

Watch the short interview: M&A expert Jeff Zulman tells mortgage brokers to hold on

Crossing the COVID-19 chasm

If you are looking for advice around acquiring or selling trail books or need a cash flow boost, contact us today for a confidential conversation.

It goes without saying that large and small businesses alike are facing unprecedented challenges in the current environment. Brokers are certainly well-versed in how to hand tough times. What we know from those times is that where there are challenges there are invariably opportunities. Sometimes it’s simply a question of finding a partner to help you realise those opportunities when they present themselves.

In 2014, Chris Booth caught wind of an unmissable opportunity. At the time, he and his other business partners were running a successful full-service financial advisory business, Announcer Mortgages (now Infocus).

When they were offered the chance to buy an undervalued client book, an acquisition that would allow them to increase their footprint and further diversify their business, they decided to try to pull together the funds to make it happen. Knowing the book would eventually appreciate, they hoped to engage, convert and grow as many clients as possible before selling the book at a higher multiple.

Chris Booth, Head of Lending, Infocus

Finding funding

Having pooled their income streams, Chris and his partners shopped around for lenders to fund the purchase. Unhappy with the options available to them, Chris spoke to the Executive Director at his aggregator who facilitated an introduction to TrailBlazer Finance’s Managing Director, Jeff Zulman. Using a specialist trail book loan from TrailBlazer, Chris and his partners were able to borrow against Announcer’s mortgage trail book, rather than risk personal assets, in order to free up the capital to buy the book.

“In the end, we proceeded with the loan purely because of Jeff and the team. They made themselves physically available to us throughout the process and it gave us great confidence, both personally and professionally, that we were making the right decision with the right lender.”

Making growth happen

At the time of purchase, Chris was working with another part-time broker. While the business didn’t convert quite as many clients as they’d bullishly projected, they did manage to sign on around 500 fee-paying full-service clients from that book alone. By the time he and his partners decided to sell the business three years later, Announcer had increased in size to three full-time brokers, their client roster had more than doubled and the business had grown by almost 130 per cent in terms of the underlying trail. They subsequently sold the business to Infocus in 2017, repaying any remaining debt and banking a tidy sum.

Words of advice for brokers looking to grow

While Chris is the first to admit the industry is in a very different place in 2020, post-Royal Commission and mid-COVID pandemic, he would do it all over again. As a small business success story, does he have any advice for other brokers seeking to grow their business through acquisition?

“Using borrowed money is a good way to acquire clients and build your business quite quickly. You have a warm opportunity to call which makes it so much easier than building a book from scratch. Would I buy a mortgage book right now? Absolutely yes, the multiples are good, even though the market has some unknowns after the Royal Commission.

Acquisitions done properly absolutely work. However, be ready for it to take far longer than you’d expect to work a client book effectively. Ultimately, you still have to win the hearts and minds of the clients. One of the biggest learnings from the financial planning industry is that they didn’t try to win the clients. You have to call and build relationships, be proactive and be positive. Building those relationships is everything.”

Let us help

If you would like to find out about how we can help your business grow with our unique loan products for brokers and other white-collar professionals, please contact us on 1300 139 003 or at info@trailblazerfinance.com.au

Words of advice for mortgage brokers and planners from an eternal optimist, TrailBlazer Finance Managing Director, Jeff Zulman

I am a person who thrives on stress. This is often much to the ire of my wife and family – work and otherwise. However, there are certainly times when the added clarity provided by a productive burst of cortisol can help shape the path forward when others are understandably mired in anxiety and indecision.

The COVID- 19 pandemic is, of course, a disaster on a global scale. Yet, perversely, it provides each one of us an opportunity to adapt, modify, seize the opportunity that change affords and ultimately thrive. The challenge is to retain enough presence to see the opportunity, even in a crisis situation.

My focus, as a businessman and financier, is on the things I can influence and change in order to prepare now for what will inevitably follow.

By way of example, my team has instituted daily Zoom “stand-up” calls. Previously these daily physical meetings were simply rapid-fire sessions designed to ensure we were all on the same page. Today, our Zoom calls not only ensure that clear communication continues, but they have become a vital vehicle for team engagement.

Of course, mortgage brokers and financial planners are well acquainted with working from home or small offices; coffee shops their second meeting room. Now we are all adapting to a world where young and old alike have a new litany of words in their Lexicon: Zoom, Hangouts, Webex. And there’s plenty of upside for our new virtual reality. We can bank the time savings gained from not sitting in traffic and commuting to client meetings, and in doing so improve productivity as well as increasing the frequency and depth of interactions – cut through the superficial and connect on a deeper level. When we deal with how people are feeling, just as much as what they are thinking, we can drive more genuine, long-lasting engagement.

So how do you identify those areas where you can retain control, adapt where you need to and identify and seize opportunities, however small?

What can you do to prepare for what lies ahead?

1. Embrace your learnings and see them as opportunities.

This time of crisis will ultimately forever shape and change the way we do business. As the founder and MD of a small business, by design, I have been able to build and scale my business so it can operate virtually. Most in the broking and planning community would find themselves in a similarly fortunate situation. There is a chance many businesses will never look back from having remote workforces. I will certainly encourage my team to continue to work increasingly from home– provided they remain goal-focused and productive. I see these six months as a training ground for a new, more virtual tomorrow.

2. Sniff out inefficiencies and solve them.

Process improvement. A lot of us despise the term, and like even less identifying, designing and implementing process enhancements. But all of us know that there is only upside if we can get it right. Think about how to do things better, faster and cheaper. Are there out of the box software solutions you can use to solve ineffective client management systems or product delivery? Where can you automate workflows and repetitive tasks? What gaps need to be plugged in the way you do things so you can do them better?

3. Futureproof. Adapt your business model.

A common cause of anxiety is around concentration risk and subsequent exposure. Diversifying your business – products, verticals– it takes time, cost and energy, but this sort of transformation has the potential to drive tremendous top-line growth and defray risk. It doesn’t mean you have to become an expert in a variety of new financial services yourself. Rather seek out others who have a similar profile, work ethic and value system as you. Together provide a broader range of services. Remember that often 1+1=3. We have helped countless clients build value in their businesses by embracing a more diverse revenue model through acquisition of established books of business, mergers, or funding the hiring of additional skills and expertise to target new markets.

4. Cultivate your relationships.

One thing we will come out of social isolation bearing is an appreciation for the strength of our relationships. We are seeing some of the best and worst, but largely the best, from other people, Governments and businesses, as we grapple collectively with the ever-changing situation. Collective goodwill and compassion are at an all-time high, so now is the time to reflect on how we can pay that forward in our personal and business relationships. People will remember how we responded during this time and it will colour the way we move forward.

5. Above all, prioritise.

Fight your battles and direct your energies where they most need to be focused–be that towards your families and well being, finances, clients or communities or, most likely, a combination of all of the above. Be kind to yourself and do what you can. Structure, routine and exercise help me keep moving forward. Where you can, try to prioritise and set realistic goals – it can be a good way to reclaim a sense of control.

I don’t know how long this will last, but I do know that the world will not come to an end in three to six months. It may be battered and broken in places and undoubtedly there will be a period of rebuilding, but ultimately many will emerge from this wiser and stronger, and certainly more resilient.

And we can help. We are here to do what we have always done, assist other small businesses to survive and thrive through uncertainty and beyond.

Just remember, you are more adaptable than you realise. Stay safe, be well and take care.